Cost of capital solved problems pdf

The Weighted Average Cost of Capital is one of the important parameters in finance analysis and it will help several applications like firm valuation, capital budgeting analysis, and EVA (Berry

Component cost equation component cost of capital maturity of the security outflow at end of period t (coupon, principal, dividend) underwriting and flotation costs net amount received by the firm at t 0 after subtracting (1 ) (1 ) (1 ) (1 ) Solve this equation for 0 1 2 2 1 1 0 …

The Cost of Capital: The Swiss Army Knife of Finance Aswath Damodaran April 2016 Abstract There is no number in finance that is used in more places or in more contexts than the cost of capital. In corporate finance, it is the hurdle rate on investments, an optimizing tool for capital …

A company’s overall cost of capital is a weighted average of the cost of debt and the cost of equity. For example, if a company’s debt/equity ratio is 30/70 and the after-tax cost of debt is 4% and the cost of equity is 10.5%, the company’s overall cost of capital is 0.30 * 4% plus 0.70 * 10.5%, or 8.55%.

In question 9, the discount rate has been ignored because we do not take into account the time value of money while computing simple payback period.

Solved Problems. SOLVED PROBLEMS COST OF CAPITAL Problem 1 Calculate the cost of capital in the following cases: i) ii) X Ltd. issues 12% Debentures of face value Rs. 100 each and realizes Rs. 95 per Debenture. The Debentures are redeemable after 10 years at a premium of 10%. Y.

Cost of Capital. An Overview of the Cost of Capital The cost of capital acts as a link between the firms long-term investment decisions and the wealth of the owners as determined by investors in the marketplace. It is the magic number that is used to decide whether a proposed investment will increase or decrease the firms stock price.

The cost of capital is not simply the interest paid on long-term debt. The cost of capital is a weighted average of the costs of all sources of financing, both debt and equity. 13-9 The internal rate of return is the rate of return on an investment project over its life. It is computed by finding the discount rate that

Mar 31, 2012 · It has already been stated that the cost of capital is one of the most crucial factors in most financial management decisions.However, the determination of the cost of capital of a firm is not an easy task. The finance manager is confronted with a large number of problems, both conceptual and practical, while determining the cost of capital of a firm.

The firm’s current market value is million; cost of equity is 15% while cost of debt before tax is 8%. Kiki is considering reducing debt borrowing to 30% debt and 70% equity. Tax rate is 30%. Calculate Kiki’s firm value and WACC if the firm reduces debt financing and increases equity financing.

First we calculate the marginal cost of capital for each source of capital such as equity and debt, and then take the weighted average of these costs. While calculating the WACC is a straight-forward calculation, and even getting the values of equity and debt is easy, there are some practical problems in calculating the cost of equity and cost

Capital Asset Pricing Model Homework Problems Solve for the minimum variance portfolio using the rst-order optimality conditions, i.e., Which rm has a higher cost of equity capital? 19. Consider a world with only two risky assets, Aand B, and a risk-free asset. The two risky

Problems with Calculating WACC Finance Train

Fundamentals of Financial Management Third Edition [Book]

Solutions to Problems . P10-1. LG 1: Concept of cost of capital . Basic. a. The firm is basing its decision on the cost to finance a particular project rather than the firm’s

The Marginal Cost of Capital and the Optimal Capital Budget WEB EXTENSION 12B If the capital budget is so large that a company must issue new equity, then the cost of capital for the company increases.This Extension explains the impact on the opti-mal capital budget. MARGINAL COST OF CAPITAL (MCC) The marginal costof any item is the cost of

The marginal cost of capital is the cost that a company incurs by raising each additional dollar. This weighted value combines the marginal costs for issuing preferred stock, common stock and debt, which are the three different methods of raising capital. Shares cost the company through the expense of paying dividends.

NPV equation and solving for a discount rate t hat makes the NPV = 0. Equivalently, IRR is solved by determining the rate that equates the PV of cash inflows to the PV of cash outflows. Method: Use your financial calculator or a spreadsheet; IRR usually cannot be solved manually. If IRR opportunity cost of capital (or hurdle rate),

Economic Order Quantity Problems and Solutions is problems set addressing key issues of ordering and holding/carrying cost of inventory management….

Jan 01, 2016 · Example Solving Capital Budgeting Problems This video walks you through how to work the types of capital budgeting project problems you are likely to …

Basic Concepts of Capital Structure A Problem Solving Approach. Basic Concepts of Capital Structure. this article derives a formula for the cost of capital with flotation costs. It is

of x= 20%. Its capital budget is B= million this year. The interest rate on company™s debt is r d = 10% and the company™s tax rate is T= 40%. The company™s common stock trades at P 0 = per share, and its current dividend of D 0 = per share is expected to grow at a …

Engineering Economics 4-1 Cash Flow Cash flow is the sum of money recorded as receipts or disbursements in a project’s financial records. A cash flow diagram presents the flow of cash as arrows on a time line scaled to the magnitude of the cash flow, where expenses are down arrows and receipts are up arrows. Year-end convention ~ expenses

Solutions to the 13 Biggest Finance, Management and Marketing Problems that Affect Entrepreneurs and Businesses By Dr. Robert D. Hisrich Garvin Professor of Global Entrepreneurship

Feb 17, 2015 · 88868074 capital-budgeting-solved-problems 1. FINANCIAL MANAGEMENT Solved Problems Rushi Ahuja 1 SOLVED PROBLEMS – CAPITAL BUDGETING Problem 1 The cost of a plant is Rs. 5,00,000. It has an estimated life of 5 years after which it would be disposed off (scrap value nil).

Nov 15, 2017 · Described the procedure and concept to calculate cost of Debt, Cost of Preference Shares, Cost of Equity and Cost of Retained Earnings. Student can …

7. WORKING CAPITAL MANAGEMENT SOLUTIONS TO ASSIGNMENT PROBLEMS Problem No – 1 Sales (units) = 10 2,60,000 = 26,000 units Inventory Norms Credit Norms RMHP – 3 weeks DECP – 8 weeks WIPHP – 3 weeks CPP – 5 weeks FGHP – 2 weeks Cost Structure – for ` 10. Particulars Amount ` DM 3 DL 4 OH 2 Total Cost 9 (+) Profit 1 Selling Price 10

2.4 Problems with IRR 2.5 Comparison of NPV and PI So great care is required to be observed for estimating the project life. Cost of capital is being considered as discounting factor which has undergone a change over the years. Cost of capital has different connotations in different economic philosophies. This problem can be solved if

1 Solutions to Capital Structure Problems 1. Kau Real Estate Kau Real Estate Inc currently uses no debt. EBIT is expected to be ,000 forever and the cost of capital is currently 12%. The corporate tax rate is 40%. a) What is the market value of Kau Real Estate?

The current market price of the company’s equity share is Rs. 200. For the last year the company had paid equity dividend at 25 per cent and its dividend is likely to grow 5 per cent every year. The corporate tax rate is 30 per cent and shareholders personal income tax rate is 20 per cent.

The cost of capital is the company’s cost of using funds provided by creditors and shareholders. A company’s cost of capital is the cost of its long-term sources of funds: debt, preferred equity, and common equity. And the cost of each source reflects the risk of the assets the company invests in. A

A company is trying to decide whether to buy a machine for $ 80,000 which will save a cost of ,000 pa for 5 years and which will have a resale value of $ 10,000 at the end of year 5. The company’s policy is to undertake a project that yields a return of 10% or more.

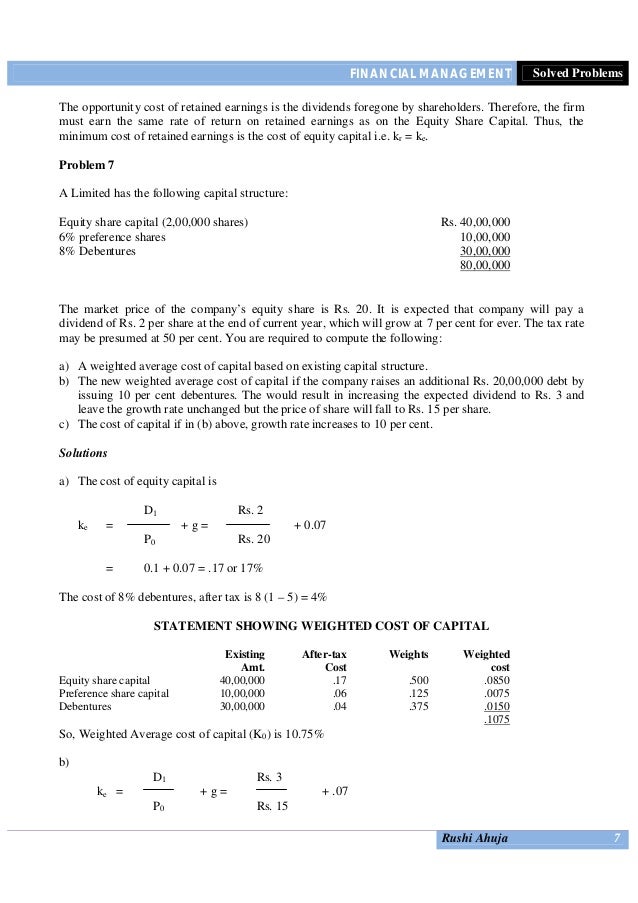

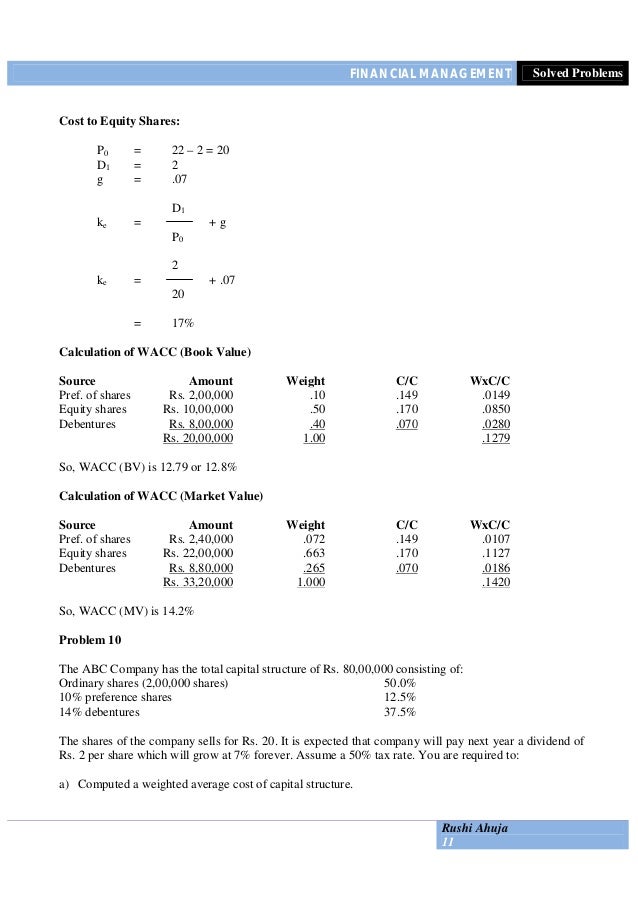

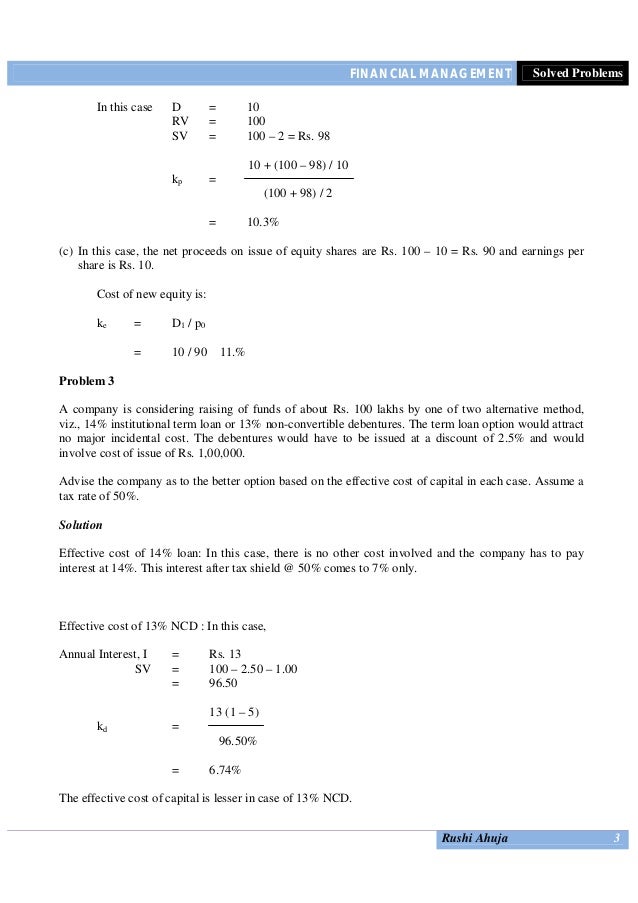

Feb 17, 2015 · 1. FINANCIAL MANAGEMENT Solved Problems Rushi Ahuja 1 SOLVED PROBLEMS – COST OF CAPITAL Problem 1 Calculate the cost of capital in the following cases: i) X Ltd. issues 12% Debentures of face value Rs. 100 each and realizes Rs. 95 per Debenture. The Debentures are redeemable after 10 years at a premium of 10%.

Cost of Capital Practice Problems 1. Why is it that, for a given firm, that the required rate of return on equity is always greater than the required rate of return on its debt? The required rate of return on equity is higher for two reasons: • The common stoc k of a company is riskier than the …

CAPITAL BUDGETING 1 Typical Capital Budgeting Decisions We could solve the problem like thisWe could solve the problem like this Present Value of an Annuity of Periods 10% 12% 14% 10.909 0.893 0.877 y$ • The firm’s cost of capital is usually regarded as the

Cost of Capital + Website Applications and Examples

period the assumption of risk of the Tax Savings (TS) which is equal the cost of debt (Kd) and ,which it is equal to Ku (cost of unlevered equity) during residual periods. Taggart (1991) investigate a formulation to cost of equity Ke and weighted average cost of capital (WACC) for …

FINANCIAL MANAGEMENT Solved Problems Rushi Ahuja 1 SOLVED PROBLEMS – COST OF CAPITAL Problem 1 Calculate the cost of capital in the following cases: i) X Ltd. issues 12% Debentures of face value Rs. 100 each and realizes Rs. 95 per Debenture. The Debentures are redeemable after 10 years at a premium of 10%.

Cost of Capital, + Website: Applications and Examples (Wiley Finance) [Shannon P. Pratt, Roger J. Grabowski, Richard A. Brealey] on Amazon.com. *FREE* shipping on qualifying offers. A one-stop shop for background and current thinking on the development and uses of rates of return on capital Completely revised for this highly anticipated fifth edition

conviction that students can really learn cost accounting by solving problems, the theory and problems approach has been adopted to fully meet all the examination needs of the students in one book. Thus apart from well organised theory, the book has sufficient number of solved problems and illustrations and unsolved problems

The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so: fT = (4.4 / 7.65)(.08) + (.45 / 7.65)(.06) + (6.8 / 7.65)(.04) fT = .0682, or 6.82% The initial cash outflow for the project needs to be adjusted for the flotation costs.

Now A sees that the Weighted Average Cost of Capital of Company X is 10% and the return on capital at the end of the period is 9%, The return on capital of 9% is lower than the WACC of 10%, A decides against investing in this company X as the value he will get after investing into the company is less than the weighted average cost of capital.Finance 100 Problem Set Capital Structure (Alternative Solutions) Note: Where appropriate, the flnal answer” for each problem is given in bold italics for those not interested in the discussion of the solution. I. Formulas This section contains the formulas you might need for this homework set: 1. The Weighted Average Cost of Capital (WACC

The Cost of Capital. ANSWERS TO END-OF-CHAPTER QUESTIONS. 10 1 a. The weighted average cost of capital, WACC, is the weighted average of the after tax component costs of capital—debt, preferred stock, and common equity. Each weighting factor is the proportion of that type of capital in the optimal, or target, capital structure. b.

cost of capital is ten percent, the NPV can be calculated and the capital budgeting decision be made. Except for the operating cash flows, all the cash flows for the Payback Period rule are obtained exactly in the same way that they are obtained for the NPV rule. The …

ÎIt does not cover the opportunity cost of the capital (initial investment) (p.247 table 9-4 and figure 9-1) 2. NPV-Based (or Economic) Break-Even Analysis ÎIt is more properly because the opportunity cost of the capital is taken into consideration ÎThe NPV at the economic break-even point is zero

www.finance-assignment.com

With the growing complexities involved in corporate financial decisions, financial management has undergone a sea change in recent years. Fundamentals of Financial Management focuses on keeping readers abreast of these changes and acquainting them with the theoretical concepts and analytical tools in the field of financial management.

Solutions to Problems . Note to instructor: Since the firm’s required return is 10% the cost of capital is greater than the expected return and the project is rejected. (Subsequent IRR problems have been solved with a financial calculator and rounded to the nearest whole percent.)

How to Calculate the Marginal Cost of Capital Pocketsense

Capital budgeting techniques multiple choice questions

Economic Order Quantity Problems and Solutions Accountancy

Aswath Damodaran April 2016 Abstract New York University

Cost of Capital

02 lecture 8 University of Manitoba

https://en.wikipedia.org/wiki/Weighted_average_cost_of_capital

Cost of Capital Practice Problems Solutions

CAPITAL BUDGETING Sacramento State

Chapter 10

COST himpub.com

Cost of Capital.pdf Cost Of Capital Book Value

Now A sees that the Weighted Average Cost of Capital of Company X is 10% and the return on capital at the end of the period is 9%, The return on capital of 9% is lower than the WACC of 10%, A decides against investing in this company X as the value he will get after investing into the company is less than the weighted average cost of capital.

CHAPTER 14 COST OF CAPITAL Auburn University

02 lecture 8 University of Manitoba

A company’s overall cost of capital is a weighted average of the cost of debt and the cost of equity. For example, if a company’s debt/equity ratio is 30/70 and the after-tax cost of debt is 4% and the cost of equity is 10.5%, the company’s overall cost of capital is 0.30 * 4% plus 0.70 * 10.5%, or 8.55%.

Aswath Damodaran April 2016 Abstract New York University

The Marginal Cost of Capital and the Optimal Capital Budget WEB EXTENSION 12B If the capital budget is so large that a company must issue new equity, then the cost of capital for the company increases.This Extension explains the impact on the opti-mal capital budget. MARGINAL COST OF CAPITAL (MCC) The marginal costof any item is the cost of

Fundamentals of Financial Management Third Edition [Book]

The weighted average flotation cost is the sum of the weight of each source of funds in the capital structure of the company times the flotation costs, so: fT = (4.4 / 7.65)(.08) + (.45 / 7.65)(.06) + (6.8 / 7.65)(.04) fT = .0682, or 6.82% The initial cash outflow for the project needs to be adjusted for the flotation costs.

CHAPTER 14 COST OF CAPITAL Auburn University

99700905 cost-of-capital-solved-problems SlideShare

Solutions to the 13 Biggest Finance Management and

The firm’s current market value is million; cost of equity is 15% while cost of debt before tax is 8%. Kiki is considering reducing debt borrowing to 30% debt and 70% equity. Tax rate is 30%. Calculate Kiki’s firm value and WACC if the firm reduces debt financing and increases equity financing.

Cost of Capital Practice Problems Solutions

Cost of Capital.pdf Cost Of Capital Book Value

Aswath Damodaran April 2016 Abstract New York University

Solutions to the 13 Biggest Finance, Management and Marketing Problems that Affect Entrepreneurs and Businesses By Dr. Robert D. Hisrich Garvin Professor of Global Entrepreneurship

Capital budgeting techniques multiple choice questions

Cost of Capital. An Overview of the Cost of Capital The cost of capital acts as a link between the firms long-term investment decisions and the wealth of the owners as determined by investors in the marketplace. It is the magic number that is used to decide whether a proposed investment will increase or decrease the firms stock price.

L08 Cost of Capital Lehigh University

WEIGHTED AVERAGE COST OF CAPITAL uuooidata.org

Cost of Capital.pdf Cost Of Capital Book Value

1 Solutions to Capital Structure Problems 1. Kau Real Estate Kau Real Estate Inc currently uses no debt. EBIT is expected to be ,000 forever and the cost of capital is currently 12%. The corporate tax rate is 40%. a) What is the market value of Kau Real Estate?

Chapter 10

The Cost of Capital: The Swiss Army Knife of Finance Aswath Damodaran April 2016 Abstract There is no number in finance that is used in more places or in more contexts than the cost of capital. In corporate finance, it is the hurdle rate on investments, an optimizing tool for capital …

Aswath Damodaran April 2016 Abstract New York University

Capital budgeting techniques multiple choice questions

COST himpub.com

Engineering Economics 4-1 Cash Flow Cash flow is the sum of money recorded as receipts or disbursements in a project’s financial records. A cash flow diagram presents the flow of cash as arrows on a time line scaled to the magnitude of the cash flow, where expenses are down arrows and receipts are up arrows. Year-end convention ~ expenses

7. Working Capital Management MASTERMINDS For CA

conviction that students can really learn cost accounting by solving problems, the theory and problems approach has been adopted to fully meet all the examination needs of the students in one book. Thus apart from well organised theory, the book has sufficient number of solved problems and illustrations and unsolved problems

Cost of Capital Practice Problems Solutions