Cra employer guide source deductions

Who Wrote the Book on Payroll Remittances (Source Deductions)? That would be the CRA. The definitive guide is called T4001 Employers’ Guide — Payroll Deductions and Remittances and is available in HTML or as a PDF. On the first read through, it’s kind of like putting together Swedish furniture.

Determination of Exemption of an Indian’s Employment Income see Guide T4001, Employers’ Guide “ Payroll Deductions and Remittances, and Guide, Use the Payroll Deductions Guide T4001, Employers’ Guide – Payroll Deductions What You Need to Know About Your Payroll Remittance Schedule. As an employer.

payroll 2020 payroll deductions online calculator guide adp payroll payroll deductions online calculator guide, biweekly payroll payroll deductions online calculator guide weekly monthly payroll 2020 pdoc payroll calculator cra payroll calculator CRA EMPLOYER DEDUCTIONS 2020 www cra gc ca payroll calculator payroll calculator 2020 CRA

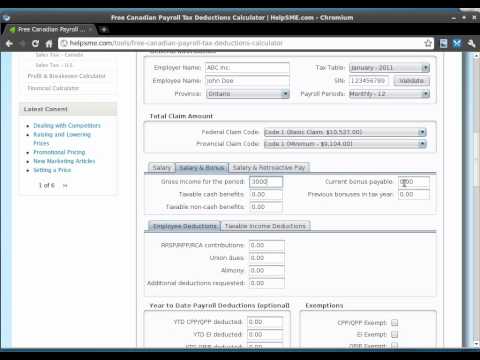

Jun 25, 2019 · If you’re looking for a simple way to calculate payroll taxes and net pay for a single employee, the CRA payroll deductions online calculator is often the quickest option. This article will give detailed steps showing you how to use the CRA payroll deductions online calculator.

www.cra.gc.ca Use this guide if you are: Remittance thresholds for employer source deductions Remitter types AMWA1 Due dates Regular remitter Less than ,000 We have to receive your deductions on or before the 15th day of the month after the month you paid your employees.

My Payment is an online payment option that allows individuals and businesses to pay taxes via the Canada Revenue Agency (CRA) website.. The My Payment service is offered through Interac* Online and is a quick, easy, and secure way to make payments to the CRA.My Payment simplifies accounting because the funds leave your account immediately. So there is no need to monitor your account …

May 01, 2011 Rating: CRA Employer’s Guide by: Lake Siobhaun, I forgot to mention that you will probably want to visit the CRA website and download CRA’s publication “Employer’s Guide – Payroll Deductions and Remittances”. It has some nice worksheets to help you prove …

Jan 31, 2011 · Tutorial for calculating payroll taxes and deductions in Canada. Includes instructions on how to use the free HelpSME.com payroll calculator. Download it at:…

What is statement of account for current source deductions. Employers’ Guide – Payroll Deductions and Remittances – asialifecambodia.com The following are the responsibilities of the employer and, in some circumstances, the trustee and payer: Open and maintain a payroll program account. or tips to your losses you get certain what is

Dec 17, 2018 · Effective with the January 1, 2017 edition, the Canada Revenue Agency is no longer publishing the paper and CD versions of the Guide T4032, Payroll Deductions Tables. The digital versions of the guide continue to be available on our website at canada.ca/payroll.

I attached CRA Form T1213 (Request to reduce tax deductions at the source for year 2018). I also enclosed separate sheets containing further information about my employer’s contact person and a copy of the payment arrangement contract (RRSP pre-authorized deposit via Questrade).

This guide is designed to advise employers (and payers) of their fiscal obligations. It contains information regarding the source deductions they are required to withhold from the remuneration they pay and the employer contributions they must make. This document is only available in electronic format.

You will notice the current payment is the total amount of source deductions you are remitting to CRA. Source deductions for the period = Total CPP (employer and employee portions) + EI (employer and employee portions) + Income tax withheld at source. My preference is to NOT use RC107 Remittance Voucher for Current Source Deductions.

Revenu Québec- Summary of Source Deductions and Employer

TaxTips.ca Reduce income tax payments now for current

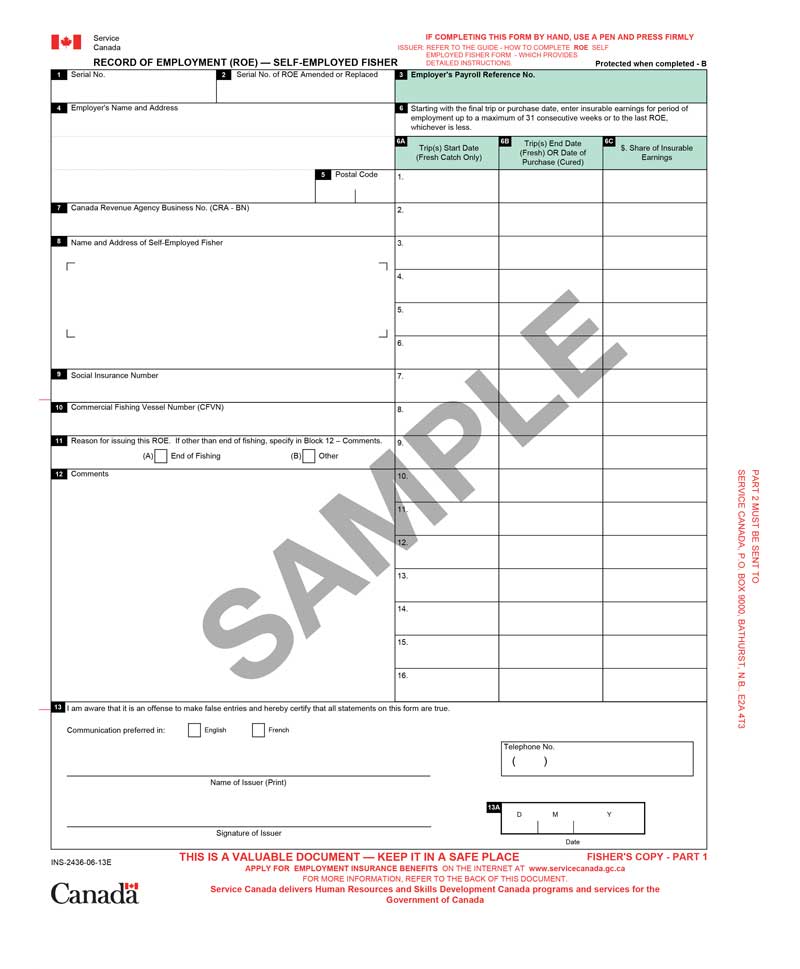

The employer is also obliged to complete and issue an ROE (Record of Employment) within five days of when the employee stops working for the company. How to calculate payroll deductions. Payroll deductions can be calculated using CRA’s online payroll calculator. Many bookkeeping software programs also have a built-in feature for payroll

[ ] Check for Authorized Income Tax Deductions or Credits: Check your payroll files for employees with authorized CRA or Revenu Québec income tax deductions or credits for the current tax year, e.g., a Letter of Authority issued by the CRA based on the employee completion of form T1213. Review the source deduction settings for any such

These are penalties for employers who fail to remit CRA source deductions within the required due dates. The default due date for CRA remittances is the 15 th of the month following. For example, November 15 is the default due date for employee direct deposits dated October 2.

Payroll guide for employers, trustees, and payers who need information on deducting and remitting CPP, EI and income tax from amounts paid.

As a Canadian employer, there are five steps to running payroll: 1. Opening and operating a payroll account with the Canada Revenue Agency (CRA). 2. Collecting required information from employees, such as their social insurance number (SIN) and a completed federal and provincial TD1 form. 3. Making the appropriate Canadian payroll deductions from employees’ pay each…

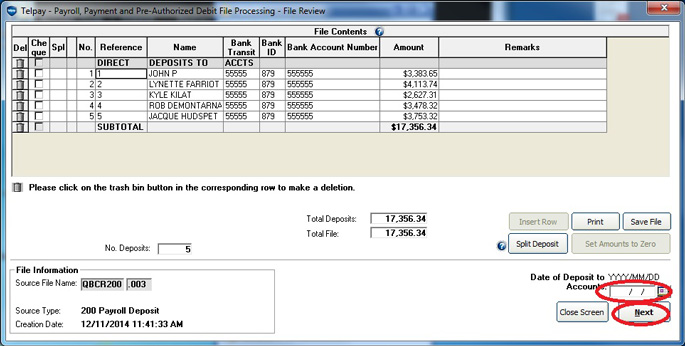

Option 1 – Complete with Payroll File-This will let you add it in while going through the transmitting steps.Please call Telpay’s customer service for this option 800-665-0302. Option 2 – Separately-Go to ‘Add new Billers’.Search for CRA Source Deductions, select the correct biller.

The form required for reducing Quebec tax deductions at source is TP-1016-V Application for a Reduction in Source Deductions of Income Tax. For more information see the CRA article on reducing remuneration subject to income tax, which is in T4001 Employers’ Guide – Payroll Deductions and …

Jan 07, 2019 · Walk-through of the easiest method of paying Canada Revenue Agency for employee payroll source deductions. Employee Payroll Source deductions are …

– TP-1015.G-V – Guide for Employers: Source Deductions and Contributions, section 6.3. CPP Contribution Calculation for Combined Employment and Self-Employment Income. Since self-employment income does not have CPP contributions deducted at source (usually), the amount of the contribution is calculated on the tax return.

When do you need to remit your employee payroll deductions? When you pay salaries, wages, or give a taxable benefit to an employee, you have to make source deductions from that amount. Deductions must be remitted to the CRA regularly and are based on the schedule and type in which the CRA has determined. You can find out your remitter type here.

Sep 19, 2019 · Figuring out how to run payroll for your small business can be difficult. That’s why we’ve created this detailed step-by-step guide on how to run payroll in Canada. From hiring your first employee to easily running payroll and filing your own T4s, we’ve covered everyth

Represent a Client at cra.gc.ca/representatives, if you are an authorized employee or representative. Remittance thresholds for employer source deductions Remitter types AMWA1 Due dates Regular remitter Less than ,000 We have to receive your deductions on or before the 15th day of the month after the month you paid your employees.

Aug 30, 2018 · The guide from CRA here is a good starting point. When in doubt, contact your professional advisor. When we talk about source deductions, If you click on the Employer Remittance Summary

If you are a new employer, or your average monthly withholding amount (AMWA) two years ago was less than ,000, you are a regular remitter. Remittance is due to the CRA before the 15th day of the month, after the month you paid employees/made the deductions.

CRA Business Number (CRA BN) The Canada Revenue Agency Business Number is an employer’s “account number” that they are assigned when they register with the CRA as an employer. The source deductions (employee’s income tax, CPP and EI premiums plus the employer’s CPP and EI premiums) are sent to this account.

Jan 12, 2018 · These penalties can be quite substantial. The CRA’s Employers’ Guide to Payroll Deductions and Remittances breaks down, in detail a complete list of penalties, interest and possible consequences which will occur if Payroll Source deduction and withholdings are not prepared correctly and remitted on time. In summary, penalties may include:

Source deductions refers to the portion of pay you’re legally required to withhold from your employees’ paychecks and remit to the Canada Revenue Agency on their behalf. They’re made up of Canada Pension Plan contributions, Employment Insurance premiums, …

Employers’ Guide Payroll Deductions and Remittances Use this guide if you are: an employer; the Canada Revenue Agency’s Web site, from an account at a participating Canadian financial institution. For more information on this self-service option, go to My Payment.

Remit Source Deductions. Each month both families must remit their employer source deductions (CPP and EI) to the CRA no later than the 15th of the month for the previous month’s deductions; Prepare and Provide Pay Stubs. Both families must provide the nanny with a …

Mar 14, 2018 · Reducing the tax taken from your pay cheque. If you’re an employee, your employer will deduct income tax from your pay cheque. This is known as tax deductions at source. Your employer then sends this tax on your behalf to the Canada Revenue Agency (CRA).

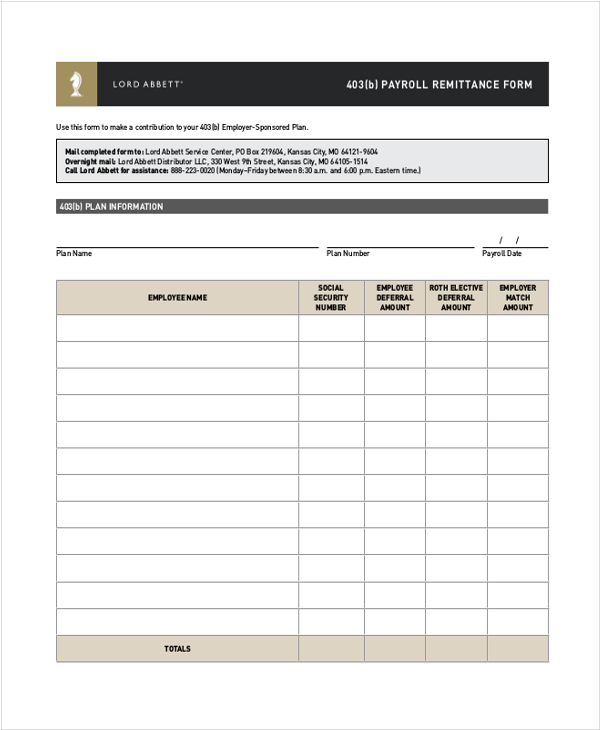

PD7A Form is a Statement of account for current source deductions. This is the document necessary for individuals obtaining a business with employees. You should fill out this form to send in Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums, and income tax deductions to the Canada Revenue Agency (CRA) on their behalf.

Employers’ Guide Payroll Deductions and Remittances public holiday recognized by the Canada Revenue Agency (CRA), we consider your payment to be on time if we receive it on the next business day. For a list of public Remittance thresholds for employer source deductions

Chapter 3 Source deductions – Your Complete Guide to

Source deductions refer to the money you withhold from your employees’ paycheques and remit to the Canada Revenue Agency (CRA). These deductions include Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums and income tax.

deductions to Revenu Québec, and send the EI and federal tax deductions to the CRA. Visit Revenu Québec at www.revenuquebec.ca, get their guide TP-1015.G-V, Guide for Employers – Source Deductions and Contributions, or write to them at, 3800 rue de Marly, Québec QC G1X 4A5, if …

The employer’s name, address and business contact number, as applicable. New employers are classed as regular remitters by the CRA, which means you have to remit your deductions so the Canada Revenue Agency receives them on or before the 15th day of the month following the month you made the deductions. Later, once you have established a

Guide to Filing the RL-1 Slip: Employment and Other Income RL-1.G-V; Guide to Filing the RL-1 Summary: Summary of Source Deductions and Employer Contributions RLZ-1.S.G-V; Reduction of the Contribution to the Health Services Fund: Creation of Specialized Jobs LE-34.1.12-V

Mar 04, 2019 · Once an employee has reached the maximum threshold, EI deductions and the related employer contribution will cease. EI premiums can be calculated using the CRA’s Payroll Deductions Online Calculator or by using tables provided in the Guide T4302, Payroll Deductions Tables and Guide T4008, Payroll Deductions Supplementary Tables.

If you do not remit your source deductions and employer shares of CPP and EI as and when required, the CRA can take actions against you. For more information, go to Failure to pay amounts deemed to be held in trust. Forms and publications. Guide T4001, Employers’ Guide – Payroll Deductions and Remittances; Guide T4130, Employers’ Guide

In addition to simplifying payroll, the payroll calculator helps you know how much you owe the CRA at the end of each month. After you complete calculations for your employees, you can also view, print and save a summary of your employer remittance amounts from a separate page.

Chapter 4 How to remit payroll deductions – Your

CRA My Payment RBC Royal Bank Accounts & Services

/payrollfiles-57a621f05f9b58974a262cf8.jpg)

CRA Business Number (CRA BN) HeartPayroll

Step-by-Step Guide to Canadian Payroll Deductions and

CRA Source Deduction Payments – Telpay

payroll deductions online calculator guide Payroll

T4032ON Payroll Deductions Tables – CPP EI and income

https://en.m.wikipedia.org/wiki/Payroll

How to Deduct Source Deductions QuickBooks Canada

How to Run Payroll in Canada (Step-by-Step Guide) — Avalon

Reducing the tax taken from your pay cheque

What Is Statement Of Account For Current Source Deductions

Remitting Employee Deductions in Canada Valley Business

The form required for reducing Quebec tax deductions at source is TP-1016-V Application for a Reduction in Source Deductions of Income Tax. For more information see the CRA article on reducing remuneration subject to income tax, which is in T4001 Employers’ Guide – Payroll Deductions and …

CRA Business Number (CRA BN) HeartPayroll

What Is Statement Of Account For Current Source Deductions

Payroll basics Payroll deductions & employee benefits

CRA Business Number (CRA BN) The Canada Revenue Agency Business Number is an employer’s “account number” that they are assigned when they register with the CRA as an employer. The source deductions (employee’s income tax, CPP and EI premiums plus the employer’s CPP and EI premiums) are sent to this account.

How to Deduct Source Deductions QuickBooks Canada

Step-by-Step Guide to Canadian Payroll Deductions and

Chapter 3 Source deductions – Your Complete Guide to

deductions to Revenu Québec, and send the EI and federal tax deductions to the CRA. Visit Revenu Québec at http://www.revenuquebec.ca, get their guide TP-1015.G-V, Guide for Employers – Source Deductions and Contributions, or write to them at, 3800 rue de Marly, Québec QC G1X 4A5, if …

Step-by-Step Guide to Canadian Payroll Deductions and

In addition to simplifying payroll, the payroll calculator helps you know how much you owe the CRA at the end of each month. After you complete calculations for your employees, you can also view, print and save a summary of your employer remittance amounts from a separate page.

Reducing the tax taken from your pay cheque

Stay Compliant with CRA’s Payroll Deductions and

Source deductions refer to the money you withhold from your employees’ paycheques and remit to the Canada Revenue Agency (CRA). These deductions include Canada Pension Plan (CPP) contributions, Employment Insurance (EI) premiums and income tax.

Remitting Employee Deductions in Canada Valley Business

payroll deductions online calculator guide Payroll

deductions to Revenu Québec, and send the EI and federal tax deductions to the CRA. Visit Revenu Québec at http://www.revenuquebec.ca, get their guide TP-1015.G-V, Guide for Employers – Source Deductions and Contributions, or write to them at, 3800 rue de Marly, Québec QC G1X 4A5, if …

CRA Business Number (CRA BN) HeartPayroll

Manual Payroll

How to Run Payroll in Canada (Step-by-Step Guide) — Avalon