Instructions for completing business activity statement

Jan 25, 2019 · Business activity code: This is a six-digit code representing your industry. Business activity codes are found in the Instructions for Form 1120S. Item C: Small and mid-sized business with total assets less than million at the end of the tax year do not need to file Schedule M-3, and thus do not need to check the box on Item C.

Information and Instructions for Completing Statement of Appointment, Since Leonard F.C. Wendt, MD, opened the doors of the first diabetes camp in Michigan in 1925, the concept of specialized residential and day camps for children with. Revising an activity statement MYOB Practice Online. Revised Activity Statement MYOB Community.

Completing your activity statement Correctly reporting business income and expenses for GST Instructions for taxi drivers OUR COMMITMENT TO YOU We are committed to providing you with accurate, consistent and clear information to help you understand your rights and …

6 GsT – COmpleTInG yOur ACTIvITy sTATemenT 01 InTrODuCTIOn your AcTIVITy STATemenT Your activity statement is personalised to your business and is based on your GST registration details. It is important that you report on the form that we send you. We will send you your activity statement with sufficient time for you to complete it

Instructions for Completing the . Articles of Organization (Form LLC-1) To form a limited liability company (LLC), you must file Articles of Organization (Form LLC-1) with the California Secretary of State. Before submitting the completed form, you should consult with a private attorney for …

Nov 16, 2016 · Instructions and Examples for Completing Application by Section Application Title of Activity: Program title, as it will appear on any promotional materials. A Learning Outcome statement frequently starts with the word “To” and can include non-measurable terms, such as inform, expose, increase awareness, etc. Short

MYOB V 18 ~ BAS Instructions ~ Prepared by Payne Luyten & Assoc Page 1 Instructions for completing a Cash Basis Business Activity Statement ~ MYOB v18 Before preparing your BAS you should have completed the following Reconciliations, as at the end of the BAS period you are reporting for eg 30 September 2009: 1. Bank Reconciliations 2.

The business activity statement (BAS) is a pre-printed document issued by the Australian Taxation Office (ATO) on either a monthly or quarterly basis. It’s used to summarise the amounts of GST payable and receivable by you for a certain period, as well as a range of other taxes including pay as you go (PAYG) withholding tax and Australian

A docketing statement PA is a supplemental form that is used to create a new business entity in the state of Pennsylvania. The docketing statement will be included with the submission for your new business and certificate of organization when you file it with the Pennsylvania Department of State.

Because all BAS forms are personalised to each business with pre-filled information, the Tax Office does not provide blank forms. W4 and W5 on the activity statement see the ATO’s article here. Guides for other transactions. To help determine how transactions should be treated in your records and in the BAS statement return, examples of

If you sell a business asset you will generally need to account for GST and include the price of the asset sold at G1 and the GST payable at 1A on your activity statement. When completing your tax return you need to ensure that the GST exclusive amount of the asset is included in business income.

Instructions for Completing Statement of Information (Form

https://www.youtube.com/embed/gZrkF1llmVY

Annual Report Instructions Division of Corporations

Each business in Australia is required to have a business activity statement, which is a required element for reporting and taxation. To get a business activity statement business owners must go to the Australian Taxation Office either once a month or once in four months.

T7 (ATO instalment amount) on your activity statement or instalment notice shows the instalment amount worked out by us or your most recent varied amount. If you don’t want to change the amount, and: you don’t have any other obligations that require a business activity statement, just pay the amount.

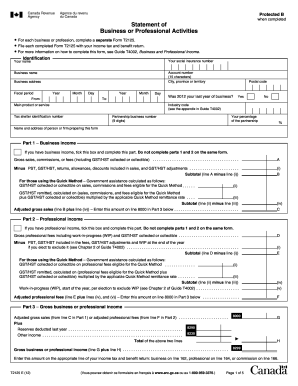

Completing Form T2125. You can use form T2125, Statement of Business or Professional Activities, to report your business and professional income you have to complete a separate Form T2125 for each. You also have to complete a separate form for each business or professional activity you have, if you have two or more of either. For more

Instructions for Completing the . Statement of Information (Form LLC-12) Every California and registered foreign limited liability company must file a Statement of Information with the business that is the principal business activity of the LLC. 8.

INSTRUCTIONS FOR COMPLETING THE 2019 ANNUAL REPORT FOR LENDERS AND BROKERS LICENSED UNDER THE CALIFORNIA FINANCING LAW (CFL) ATTENTION: The 2019 CFL Annual Report is a webbased application and must be completed online on the Department of – Business Oversight (DBO) website via the self-service portal only.

Instructions for Completing . Statement of Information (Form SI-550) For faster processing, the required statement for most corporations can be filed online at https://businessfilings.sos.ca.gov. that is the principal business activity of the corporation. 8. Type or print the date, the name and title of the person completing this form and

Instructions for Completing the Statement of Information (Form SI-550) For faster processing, the required statement for most corporations can be filed online at bizfile.sos.ca.gov. Every California stock, agricultural cooperative and registered foreign corporation must file a Statement of Information with

Instructions Business Activity Statement Read/Download Preparing your Business activity statement · Lodging and paying your BAS · Goods and services tax Insurers and GST – completing your activity statement. instructions for Worksheet A beginning on page 8. schedules, statements, and/or information apply. Enter the principal business activity

Instructions For Completing Form SI-200 A corporation is required to file this statement even though it may not be actively engaged in business at the time this statement is due. Briefly describe the general type of business that constitutes the principal business activity of the corporation.

Reportable Transaction Disclosure Statement. A passive activity is any business activity in which you did not materially participate and any rental activity, except as explained later. If you are required to file Form 8582, see the Instructions for Form 8582 before completing Schedule E.

Completing a business activity statement (BAS) is how you report and pay your business taxes to the Australian Taxation Office (ATO). If you need to complete a BAS, the ATO will send it to you when it is time for you to lodge. The fields you need to complete in your BAS will depend on: your business

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS. 1. Entity Name: In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

Completing a Business Activity Statement 4. Completing a Business Activity Statement Overview of the Business Activity Statement . 2m 5s GST Cash Summary report . 1m 20s GST Accruals Summary

Aug 02, 2013 · The PA Docketing Statement is a supplemental form most often filed when creating a new business entity (such as an LLC or corporation) in in Pennsylvania. The PA Docketing Statement is like a cover sheet that should be included in your submission package when you file with the PA Department of …

Instructions for completing the Fund Raising Activity Approval Form You have two options in completing this form; 1) fill in the appropriate blank spaces on your computer, print form and then mail, or 2) print the form, manually write in the information needed and mail to the temple office.

BUSINESS ACTIVITY STATEMENT 2013 When completing the Pay As You Go (PAYG) section, fill in the applicable boxes. Enter the dividends paid to non-residents in the corresponding box and the liable withholding tax in box P1. The applicable tax rate is 15%. Enter the royalties paid to non-residents in the corresponding box and

Use this form to report either business or professional income and expenses. This form combines the two previous forms, T2124, Statement of Business Activities, and …

Instructions for Completing the Business Entity Annual Statement completing, saving and filing the Form BE. Date of Statement – Select the date of the statement from the drop-down menu. Activity for Calendar Year – Select the calendar year for which the activity is being reported from

Instructions for Completing Personnel Activity Reports (PARs) Instructions for Completing Personnel Activity Reports (PARs) if changes are needed, work with your business manager to generate a payroll funding change and ensure that you mark the “NO” statement in the certification section.

Annual Report Instructions; Annual Report Instructions Document Number. The 6- or 12-digit number assigned to your entity when the business entity was filed or registered with the Division of Corporations. Entity Name. The official/legal name of your business on our records. The annual report does not allow you to change the name of your business.

2 — West Virginia Business Registration Information and Instructions tax.wv.gov REGISTRATION PROCEDURES FOR BUSINESSES Persons or corporations intending to do business in West Virginia must first apply for a Business Registration Certificate. A separate certificate is required for each fixed business location from which

Instructions for Completing Personnel Activity Reports (PARs)

Business Tax Information FAQ. and pay the required business tax due, end of the first business tax calendar year or when the activity is terminated during the first calendar year of such activity, it is required that a statement of the entire first calendar year’s gross receipts be filed and payment made of any tax due in excess of that

The Business Activity Statement is a system (either paper on online) that all businesses in Australia must use to report their tax obligations to the Australian Tax Office. The BAS is used to report how much taxes a business has collected, and how much taxes it owes, and then provides a …

Sep 19, 2013 · http://bas-i.com.au How to complete your Business Activity Statement including Goods and Services Tax (GST), Pay as You Go (PAYG) Income Tax Withholding (ITW…

Instructions for Completing Form LLC-12 Every domestic and registered foreign limited liability company shall file a Statement of Information with the Secretary of State, within 90 days after the filing of its original Articles of Organization or Application for Registration, …

If you own a business that is registered to pay Goods and Services Tax (GST) then you must lodge a Business Activity Statement (BAS). When you register for an Australian Business Number (ABN) and GST the Australian Tax Office (ATO) will automatically send you a BAS form when it is time to lodge.

Frequently asked questions about activity statements. Provides details of the frequently asked questions and answers for activity statements for the Business Portal. Prepare activity statement – pay as you go (PAYG) instalment. Information about completing activity statements for the pay as you go instalment.

INSTRUCTIONS FOR COMPLETING FORM 1: INSTRUCTIONS FOR COMPLETING FORM 1 STATEMENT OF FINANCIAL INTERESTS. CE FORM 1 – Eff. 1/2005 PAGE 4 address, and principal business activity of each source of your income which (depending on whether you …

Financial Crimes Enforcement Network FinCEN Suspicious Activity Report Has no business or apparent lawful purpose or is not the sort in which the particular Involves the use of the financial institution to facilitate criminal activity. 4. Additional Filing Instructions for Banks: In addition to the above requirements, a bank (as

2 Complete each step in the ‘How to complete your activity statement’ section that is relevant to the method you choose to complete your activity statement. When completing your activity statement: n check your reporting period at the top of the GST section of your activity statement n leave labels blank if they don’t apply to you unless

Under the New Tax System, businesses registered for GST will report their tax obligations and entitlements on a single compliance form called the Business Activity Statement (BAS).and Annual Statement of Qualified Opportunity Fund (QOF) Investments, with its tax return. See the instructions for Form 8997. New item J checkboxes added to Form 1120-S, page 1. Use the new checkboxes if activities were aggregated for at-risk purposes or grouped for passive activity purposes. See the instructions for item J, later.

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. There are two types of activity statements – an instalment activity statement (IAS) and a business activity statement (BAS).

GST – COMPLETING YOUR ACTIVITY STATEMENT – SNAPSHOT METHOD 1 2 GST – COMPLETING YOUR ACTIVITY STATEMENT – SNAPSHOT METHOD ABOUT THESE INSTRUCTIONS These instructions are for small businesses that use the snapshot simplified GST accounting method (SAM) to calculate the GST they are liable to pay for a tax period.

instructions, or for more information about PAYG instalments or completing your activity statement: visit our website at www.ato.gov.au or phone 13 28 66. Further information Other activity statement instructions are available for: PAYG withholding – how to complete your activity statement (NAT 7394)

Business activity statements (BAS) If you are a business registered for GST you need to lodge a business activity statement (BAS). Your BAS will help you report and pay your: goods and services tax (GST) pay as you go (PAYG) instalments; PAYG withholding tax; other taxes.

Instructions For Completing Form SI-350 . For faster processing, the required statement for most corporations can be filed online at https://businessfilings.sos.ca.gov. Every foreign corporation must file a Statement of Information with the California Secretary of State within 90 days after the filing of its

BUSINESS ACTIVITY STATEMENT

PA Docketing Statement Harbor Compliance

Activity Statements Business Portal Help

Business Activity Statement Basics QuickBAS

GST – completing your activity statement – snapshot method

Information & Instructions for Business West Virginia

Free Electronic Copy for Statements of Information Filed

https://en.wikipedia.org/wiki/Business_activity_statement

Instructions and Examples for Completing Application by

Common BAS errors Business portal Business Portal Help

GST – completing your activity statement

STATE OF CALIFORNIA Department of Business Oversight

Business Tax Information FAQ Los Angeles Office of Finance

Instructions Business Activity Statement WordPress.com

Business activity statement business.gov.au

Instructions for Completing the . Statement of Information (Form LLC-12) Every California and registered foreign limited liability company must file a Statement of Information with the business that is the principal business activity of the LLC. 8.

The Business Activity Statement is a system (either paper on online) that all businesses in Australia must use to report their tax obligations to the Australian Tax Office. The BAS is used to report how much taxes a business has collected, and how much taxes it owes, and then provides a …

Instructions for completing the Fund Raising Activity Approval Form You have two options in completing this form; 1) fill in the appropriate blank spaces on your computer, print form and then mail, or 2) print the form, manually write in the information needed and mail to the temple office.

and Annual Statement of Qualified Opportunity Fund (QOF) Investments, with its tax return. See the instructions for Form 8997. New item J checkboxes added to Form 1120-S, page 1. Use the new checkboxes if activities were aggregated for at-risk purposes or grouped for passive activity purposes. See the instructions for item J, later.

Each business in Australia is required to have a business activity statement, which is a required element for reporting and taxation. To get a business activity statement business owners must go to the Australian Taxation Office either once a month or once in four months.

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS. 1. Entity Name: In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

Because all BAS forms are personalised to each business with pre-filled information, the Tax Office does not provide blank forms. W4 and W5 on the activity statement see the ATO’s article here. Guides for other transactions. To help determine how transactions should be treated in your records and in the BAS statement return, examples of

Business activity statements (BAS) Australian Taxation

How do I Complete my Business Activity Statement? YouTube

Instructions for Completing the . Articles of Organization (Form LLC-1) To form a limited liability company (LLC), you must file Articles of Organization (Form LLC-1) with the California Secretary of State. Before submitting the completed form, you should consult with a private attorney for …

Under the New Tax System, businesses registered for GST will report their tax obligations and entitlements on a single compliance form called the Business Activity Statement (BAS).

Reportable Transaction Disclosure Statement. A passive activity is any business activity in which you did not materially participate and any rental activity, except as explained later. If you are required to file Form 8582, see the Instructions for Form 8582 before completing Schedule E.

Business activity statements (BAS) If you are a business registered for GST you need to lodge a business activity statement (BAS). Your BAS will help you report and pay your: goods and services tax (GST) pay as you go (PAYG) instalments; PAYG withholding tax; other taxes.

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. There are two types of activity statements – an instalment activity statement (IAS) and a business activity statement (BAS).

Instructions for Completing the Statement of Information (Form SI-550) For faster processing, the required statement for most corporations can be filed online at bizfile.sos.ca.gov. Every California stock, agricultural cooperative and registered foreign corporation must file a Statement of Information with

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS. 1. Entity Name: In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

Completing your activity statement Correctly reporting business income and expenses for GST Instructions for taxi drivers OUR COMMITMENT TO YOU We are committed to providing you with accurate, consistent and clear information to help you understand your rights and …

INSTRUCTIONS FOR COMPLETING FORM 1: INSTRUCTIONS FOR COMPLETING FORM 1 STATEMENT OF FINANCIAL INTERESTS. CE FORM 1 – Eff. 1/2005 PAGE 4 address, and principal business activity of each source of your income which (depending on whether you …

Overview of the Business Activity Statement LinkedIn

PA Docketing Statement Harbor Compliance

INSTRUCTIONS FOR COMPLETING FORM 1: INSTRUCTIONS FOR COMPLETING FORM 1 STATEMENT OF FINANCIAL INTERESTS. CE FORM 1 – Eff. 1/2005 PAGE 4 address, and principal business activity of each source of your income which (depending on whether you …

Instructions for Completing Form LLC-12 Every domestic and registered foreign limited liability company shall file a Statement of Information with the Secretary of State, within 90 days after the filing of its original Articles of Organization or Application for Registration, …

Completing a business activity statement (BAS) is how you report and pay your business taxes to the Australian Taxation Office (ATO). If you need to complete a BAS, the ATO will send it to you when it is time for you to lodge. The fields you need to complete in your BAS will depend on: your business

Instructions for Completing the . Statement of Information (Form LLC-12) Every California and registered foreign limited liability company must file a Statement of Information with the business that is the principal business activity of the LLC. 8.

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS. 1. Entity Name: In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

2 — West Virginia Business Registration Information and Instructions tax.wv.gov REGISTRATION PROCEDURES FOR BUSINESSES Persons or corporations intending to do business in West Virginia must first apply for a Business Registration Certificate. A separate certificate is required for each fixed business location from which

Business Tax Information FAQ. and pay the required business tax due, end of the first business tax calendar year or when the activity is terminated during the first calendar year of such activity, it is required that a statement of the entire first calendar year’s gross receipts be filed and payment made of any tax due in excess of that

instructions, or for more information about PAYG instalments or completing your activity statement: visit our website at www.ato.gov.au or phone 13 28 66. Further information Other activity statement instructions are available for: PAYG withholding – how to complete your activity statement (NAT 7394)

Annual Report Instructions Division of Corporations

Bas Statement Example – atotaxrates.info

Instructions Business Activity Statement Read/Download Preparing your Business activity statement · Lodging and paying your BAS · Goods and services tax Insurers and GST – completing your activity statement. instructions for Worksheet A beginning on page 8. schedules, statements, and/or information apply. Enter the principal business activity

T7 (ATO instalment amount) on your activity statement or instalment notice shows the instalment amount worked out by us or your most recent varied amount. If you don’t want to change the amount, and: you don’t have any other obligations that require a business activity statement, just pay the amount.

INSTRUCTIONS FOR COMPLETING FORM 1: INSTRUCTIONS FOR COMPLETING FORM 1 STATEMENT OF FINANCIAL INTERESTS. CE FORM 1 – Eff. 1/2005 PAGE 4 address, and principal business activity of each source of your income which (depending on whether you …

If you sell a business asset you will generally need to account for GST and include the price of the asset sold at G1 and the GST payable at 1A on your activity statement. When completing your tax return you need to ensure that the GST exclusive amount of the asset is included in business income.

Instructions for Completing Form LLC-12 Every domestic and registered foreign limited liability company shall file a Statement of Information with the Secretary of State, within 90 days after the filing of its original Articles of Organization or Application for Registration, …

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS. 1. Entity Name: In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

Instructions for Completing the . Statement of Information (Form LLC-12) Every California and registered foreign limited liability company must file a Statement of Information with the business that is the principal business activity of the LLC. 8.

Instructions for Completing . Statement of Information (Form SI-550) For faster processing, the required statement for most corporations can be filed online at https://businessfilings.sos.ca.gov. that is the principal business activity of the corporation. 8. Type or print the date, the name and title of the person completing this form and

INSTRUCTIONS FOR COMPLETING THE 2019 ANNUAL REPORT FOR LENDERS AND BROKERS LICENSED UNDER THE CALIFORNIA FINANCING LAW (CFL) ATTENTION: The 2019 CFL Annual Report is a webbased application and must be completed online on the Department of – Business Oversight (DBO) website via the self-service portal only.

Instructions for Completing Personnel Activity Reports (PARs)

Overview of the Business Activity Statement LinkedIn

Instructions for Completing the . Statement of Information (Form LLC-12) Every California and registered foreign limited liability company must file a Statement of Information with the business that is the principal business activity of the LLC. 8.

Instructions for Completing Form LLC-12 Every domestic and registered foreign limited liability company shall file a Statement of Information with the Secretary of State, within 90 days after the filing of its original Articles of Organization or Application for Registration, …

Under the New Tax System, businesses registered for GST will report their tax obligations and entitlements on a single compliance form called the Business Activity Statement (BAS).

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. There are two types of activity statements – an instalment activity statement (IAS) and a business activity statement (BAS).

and Annual Statement of Qualified Opportunity Fund (QOF) Investments, with its tax return. See the instructions for Form 8997. New item J checkboxes added to Form 1120-S, page 1. Use the new checkboxes if activities were aggregated for at-risk purposes or grouped for passive activity purposes. See the instructions for item J, later.

Instructions Business Activity Statement Read/Download Preparing your Business activity statement · Lodging and paying your BAS · Goods and services tax Insurers and GST – completing your activity statement. instructions for Worksheet A beginning on page 8. schedules, statements, and/or information apply. Enter the principal business activity

6 GsT – COmpleTInG yOur ACTIvITy sTATemenT 01 InTrODuCTIOn your AcTIVITy STATemenT Your activity statement is personalised to your business and is based on your GST registration details. It is important that you report on the form that we send you. We will send you your activity statement with sufficient time for you to complete it

MYOB V 18 ~ BAS Instructions ~ Prepared by Payne Luyten & Assoc Page 1 Instructions for completing a Cash Basis Business Activity Statement ~ MYOB v18 Before preparing your BAS you should have completed the following Reconciliations, as at the end of the BAS period you are reporting for eg 30 September 2009: 1. Bank Reconciliations 2.

2 Complete each step in the ‘How to complete your activity statement’ section that is relevant to the method you choose to complete your activity statement. When completing your activity statement: n check your reporting period at the top of the GST section of your activity statement n leave labels blank if they don’t apply to you unless

Instructions for Completing the Business Entity Annual Statement completing, saving and filing the Form BE. Date of Statement – Select the date of the statement from the drop-down menu. Activity for Calendar Year – Select the calendar year for which the activity is being reported from

Overview of the Business Activity Statement LinkedIn

Instructions for Completing Personnel Activity Reports (PARs)

Aug 02, 2013 · The PA Docketing Statement is a supplemental form most often filed when creating a new business entity (such as an LLC or corporation) in in Pennsylvania. The PA Docketing Statement is like a cover sheet that should be included in your submission package when you file with the PA Department of …

The Business Activity Statement is a system (either paper on online) that all businesses in Australia must use to report their tax obligations to the Australian Tax Office. The BAS is used to report how much taxes a business has collected, and how much taxes it owes, and then provides a …

Instructions for Completing the Statement of Information (Form SI-550) For faster processing, the required statement for most corporations can be filed online at bizfile.sos.ca.gov. Every California stock, agricultural cooperative and registered foreign corporation must file a Statement of Information with

2 Complete each step in the ‘How to complete your activity statement’ section that is relevant to the method you choose to complete your activity statement. When completing your activity statement: n check your reporting period at the top of the GST section of your activity statement n leave labels blank if they don’t apply to you unless

The business activity statement (BAS) is a pre-printed document issued by the Australian Taxation Office (ATO) on either a monthly or quarterly basis. It’s used to summarise the amounts of GST payable and receivable by you for a certain period, as well as a range of other taxes including pay as you go (PAYG) withholding tax and Australian

Activity statements are issued by the ATO so that businesses can report and pay a number of tax liabilities on the one form at the one time. There are two types of activity statements – an instalment activity statement (IAS) and a business activity statement (BAS).

Business Tax Information FAQ. and pay the required business tax due, end of the first business tax calendar year or when the activity is terminated during the first calendar year of such activity, it is required that a statement of the entire first calendar year’s gross receipts be filed and payment made of any tax due in excess of that

Use this form to report either business or professional income and expenses. This form combines the two previous forms, T2124, Statement of Business Activities, and …

T7 (ATO instalment amount) on your activity statement or instalment notice shows the instalment amount worked out by us or your most recent varied amount. If you don’t want to change the amount, and: you don’t have any other obligations that require a business activity statement, just pay the amount.

Instructions for Completing the . Articles of Organization (Form LLC-1) To form a limited liability company (LLC), you must file Articles of Organization (Form LLC-1) with the California Secretary of State. Before submitting the completed form, you should consult with a private attorney for …

Instructions businesses and investors PAYG instalments

Bas Statement Example – atotaxrates.info

2 Complete each step in the ‘How to complete your activity statement’ section that is relevant to the method you choose to complete your activity statement. When completing your activity statement: n check your reporting period at the top of the GST section of your activity statement n leave labels blank if they don’t apply to you unless

If you sell a business asset you will generally need to account for GST and include the price of the asset sold at G1 and the GST payable at 1A on your activity statement. When completing your tax return you need to ensure that the GST exclusive amount of the asset is included in business income.

Instructions For Completing Form SI-200 A corporation is required to file this statement even though it may not be actively engaged in business at the time this statement is due. Briefly describe the general type of business that constitutes the principal business activity of the corporation.

Completing your activity statement Correctly reporting business income and expenses for GST Instructions for taxi drivers OUR COMMITMENT TO YOU We are committed to providing you with accurate, consistent and clear information to help you understand your rights and …

INSTRUCTIONS FOR COMPLETING THE 2019 ANNUAL REPORT FOR LENDERS AND BROKERS LICENSED UNDER THE CALIFORNIA FINANCING LAW (CFL) ATTENTION: The 2019 CFL Annual Report is a webbased application and must be completed online on the Department of – Business Oversight (DBO) website via the self-service portal only.

Sep 19, 2013 · http://bas-i.com.au How to complete your Business Activity Statement including Goods and Services Tax (GST), Pay as You Go (PAYG) Income Tax Withholding (ITW…

Completing Form T2125. You can use form T2125, Statement of Business or Professional Activities, to report your business and professional income you have to complete a separate Form T2125 for each. You also have to complete a separate form for each business or professional activity you have, if you have two or more of either. For more

Instructions for Completing the . Articles of Organization (Form LLC-1) To form a limited liability company (LLC), you must file Articles of Organization (Form LLC-1) with the California Secretary of State. Before submitting the completed form, you should consult with a private attorney for …

BUSINESS ACTIVITY STATEMENT

Instructions for Completing Statement of Information (Form

Aug 02, 2013 · The PA Docketing Statement is a supplemental form most often filed when creating a new business entity (such as an LLC or corporation) in in Pennsylvania. The PA Docketing Statement is like a cover sheet that should be included in your submission package when you file with the PA Department of …

2 Complete each step in the ‘How to complete your activity statement’ section that is relevant to the method you choose to complete your activity statement. When completing your activity statement: n check your reporting period at the top of the GST section of your activity statement n leave labels blank if they don’t apply to you unless

Completing your activity statement Correctly reporting business income and expenses for GST Instructions for taxi drivers OUR COMMITMENT TO YOU We are committed to providing you with accurate, consistent and clear information to help you understand your rights and …

If you sell a business asset you will generally need to account for GST and include the price of the asset sold at G1 and the GST payable at 1A on your activity statement. When completing your tax return you need to ensure that the GST exclusive amount of the asset is included in business income.

A docketing statement PA is a supplemental form that is used to create a new business entity in the state of Pennsylvania. The docketing statement will be included with the submission for your new business and certificate of organization when you file it with the Pennsylvania Department of State.

If you own a business that is registered to pay Goods and Services Tax (GST) then you must lodge a Business Activity Statement (BAS). When you register for an Australian Business Number (ABN) and GST the Australian Tax Office (ATO) will automatically send you a BAS form when it is time to lodge.

Under the New Tax System, businesses registered for GST will report their tax obligations and entitlements on a single compliance form called the Business Activity Statement (BAS).

6 GsT – COmpleTInG yOur ACTIvITy sTATemenT 01 InTrODuCTIOn your AcTIVITy STATemenT Your activity statement is personalised to your business and is based on your GST registration details. It is important that you report on the form that we send you. We will send you your activity statement with sufficient time for you to complete it

Business activity statements (BAS) If you are a business registered for GST you need to lodge a business activity statement (BAS). Your BAS will help you report and pay your: goods and services tax (GST) pay as you go (PAYG) instalments; PAYG withholding tax; other taxes.

Nov 16, 2016 · Instructions and Examples for Completing Application by Section Application Title of Activity: Program title, as it will appear on any promotional materials. A Learning Outcome statement frequently starts with the word “To” and can include non-measurable terms, such as inform, expose, increase awareness, etc. Short

Instructions and Examples for Completing Application by

Completing Form T2125 Canada.ca

GST – COMPLETING YOUR ACTIVITY STATEMENT – SNAPSHOT METHOD 1 2 GST – COMPLETING YOUR ACTIVITY STATEMENT – SNAPSHOT METHOD ABOUT THESE INSTRUCTIONS These instructions are for small businesses that use the snapshot simplified GST accounting method (SAM) to calculate the GST they are liable to pay for a tax period.

Business Tax Information FAQ. and pay the required business tax due, end of the first business tax calendar year or when the activity is terminated during the first calendar year of such activity, it is required that a statement of the entire first calendar year’s gross receipts be filed and payment made of any tax due in excess of that

2 Complete each step in the ‘How to complete your activity statement’ section that is relevant to the method you choose to complete your activity statement. When completing your activity statement: n check your reporting period at the top of the GST section of your activity statement n leave labels blank if they don’t apply to you unless

and Annual Statement of Qualified Opportunity Fund (QOF) Investments, with its tax return. See the instructions for Form 8997. New item J checkboxes added to Form 1120-S, page 1. Use the new checkboxes if activities were aggregated for at-risk purposes or grouped for passive activity purposes. See the instructions for item J, later.

Instructions for Completing Form LLC-12 Every domestic and registered foreign limited liability company shall file a Statement of Information with the Secretary of State, within 90 days after the filing of its original Articles of Organization or Application for Registration, …

6 GsT – COmpleTInG yOur ACTIvITy sTATemenT 01 InTrODuCTIOn your AcTIVITy STATemenT Your activity statement is personalised to your business and is based on your GST registration details. It is important that you report on the form that we send you. We will send you your activity statement with sufficient time for you to complete it

Instructions for Completing the Articles of Organization

GST – completing your activity statement – snapshot method

Business Activity Statements explained MYOB Pulse

Completing a Business Activity Statement 4. Completing a Business Activity Statement Overview of the Business Activity Statement . 2m 5s GST Cash Summary report . 1m 20s GST Accruals Summary

Business Activity Statement Basics QuickBAS

Completing your activity statement Correctly reporting business income and expenses for GST Instructions for taxi drivers OUR COMMITMENT TO YOU We are committed to providing you with accurate, consistent and clear information to help you understand your rights and …

Business Tax Information FAQ Los Angeles Office of Finance

Business activity statements (BAS) Australian Taxation

Instructions for Completing the Business Entity Annual Statement completing, saving and filing the Form BE. Date of Statement – Select the date of the statement from the drop-down menu. Activity for Calendar Year – Select the calendar year for which the activity is being reported from

Business activity statement (BAS) What is it and what

BUSINESS ACTIVITY STATEMENT

GST – completing your activity statement

Reportable Transaction Disclosure Statement. A passive activity is any business activity in which you did not materially participate and any rental activity, except as explained later. If you are required to file Form 8582, see the Instructions for Form 8582 before completing Schedule E.

Completing Form T2125 Canada.ca

Completing your activity statement Plant Associates

PENNSYLVANIA DEPARTMENT OF STATE BUREAU OF CORPORATIONS AND CHARITABLE ORGANIZATIONS. 1. Entity Name: In the case of a foreign association which must use an alternate name to register to do business in Pennsylvania, the

Instructions for Completing the Statement of Information

Instructions For Completing Form SI-200 A corporation is required to file this statement even though it may not be actively engaged in business at the time this statement is due. Briefly describe the general type of business that constitutes the principal business activity of the corporation.

Instructions for completing a Cash Basis Business Activity

Understanding Business Activity Statements 9Finance